Digital Business Models in Performing Arts – Part 2: The Potential and Pitfalls of Non-Fungible Tokens

The second episode of our “Digital Business Models in the Performing Arts” series covers the complex topic of navigating the digital frontier and highlights the potential and pitfalls of non-fungible tokens for performing arts practitioners.

Selling intangible, digital products to generate income is far from being a novel business model. The global digitalization of business models has reached a level where even the older consumer generations now embrace the concept of purchasing, for example, digital photographs, books, or tickets, making the ownership of digital assets a mainstream practice. In particular, among Generation Z, purchasing, selling, and trading virtual items is really as ordinary as buying a pair of trainers. These digital natives spend a substantial part of their social time immersed in metaverse gaming platforms like Fortnite and Roblox, exploring vast virtual worlds with their avatars and engaging in financial interactions with digital goods.

The potential of these virtual ecosystems and the consumer communities that reside in them has not gone unnoticed by commercial brands, who have begun to recognize the lucrative opportunities they can offer. Leading brands, such as Nike, Gucci, and even Taco Bell, have eagerly ventured into these virtual realms, leveraging the popularity of and engagement on these platforms to promote and sell digital versions of their products. By tapping into the metaverse, brands are effectively extending their reach and capturing the attention of highly engaged consumers.

Non-Fungible Tokens (NFTs) act as ‘receipts’ of ownership for digital assets, by utilizing a unique and secure blockchain-based code. These digital assets can take different forms from virtual gaming accessories, contracts, and artworks, to branded items, collectibles, and more. Since 2021, the NFT market has witnessed explosive growth, and according to Forbes, is estimated to be valued at over $40 billion in 2023. This rapid growth has revolutionized the digital art and collectible world and unleashed new possibilities for practitioners across the creative industries to monetize their work. While visual artists and gaming enthusiasts have predominantly taken the lead, the performing arts sector has been more gradual in exploring the potential of the NFT market, which may present unique opportunities for showcasing the physical nature of live performances in the digital sphere.

One of the most significant advantages of NFTs is that they are relatively easy and affordable to create. Basically, any creative digital content—like artwork, music, or videos—can be made into NFTs, and leading NFT marketplaces such as OpenSea and Rarible are very accessible to budding NFT creators, as they have been designed with user-friendliness in mind. Generating income from NFTs is a new digital product-based business model that is definitely interesting for performing arts companies, who are traditionally reliant on public funding or philanthropy, often operate on a hand-to-mouth basis, and face challenges in finding revenue sources outside the touring of live performances. The use of NFTs can offer performing artists and organizations an opportunity to develop and sell digital versions of their shows, thereby establishing a culture of collectible merchandise around their performances. There is also a dimension of documentation, as NFTs can provide a way to engrain performances in history. By creating digital excerpts of their shows, performing arts companies can ensure that their performances are preserved for future generations. This can help to protect the cultural heritage of the performing arts industry and also enable audiences to own a piece of history.

While the use of NFTs as a business model presents exciting opportunities for performing arts companies to explore new revenue streams and engage with digital audiences, it is essential to approach this emerging technology with caution. Risks associated with NFTs encompass copyright infringement, market volatility, environmental impact, and the absence of regulation. It goes without saying that these risks necessitate careful assessment and mitigation.

One of the primary concerns surrounding NFTs revolves around the potential for copyright infringement. Performing arts companies must ensure that they own the digital content they tokenize, as selling copyrighted works may lead to legal disputes and financial losses. Furthermore, the NFT market is renowned for its volatility, with prices of blockchain-based digital assets often fluctuating dramatically. The value of NFTs is heavily influenced by factors such as trends, public sentiment, and the overall demand for digital collectibles, which can change rapidly.

Another risk associated with NFTs relates to their environmental impact. The blockchain technology used for NFTs—particularly in the case of Ethereum, which is currently the most popular cryptocurrency used to mint and sell NFTs—consumes significant amounts of energy. Despite recent improvements to Ethereum’s carbon footprint, NFTs’ energy consumption still contributes to carbon emissions to a considerable extent, and thus raises concerns about the sustainability of the NFT market. Therefore, it is key that performing arts companies carefully choose the blockchain they use to mint their NFTs on, consider its environmental implications, and evaluate whether they are in line with their own sustainability goals.

Finally, the NFT market is still a bit like the Wild West: relatively new and largely unregulated. This lack of moderation creates potential risks such as fraudulent listings, counterfeit NFTs, and inadequate legal protection, which can all have implications for the credibility and financial stability of performing artists and arts organizations. Also, a major bottleneck for NFT sales is the use of cryptocurrency, as most mainstream consumers do not necessarily possess a crypto wallet, or know how to set one up.

The use of NFTs in the performing arts is still in its infancy. Again, the music industry appears to be ahead of other performing arts sectors such as dance, circus and theatre in seizing the opportunities of the NFT market. For example, Snoop Dogg has been a keen explorer of NFT-based business models and released several albums and collectible items as NFTs. One of his recent projects is a collaboration with Clay Nation to launch an NFT collection entitled ‘Baked Nation’ on blockchain Cardano. The collection includes over 10,000 visual images of handmade clay figurines of Snoop Dog himself.

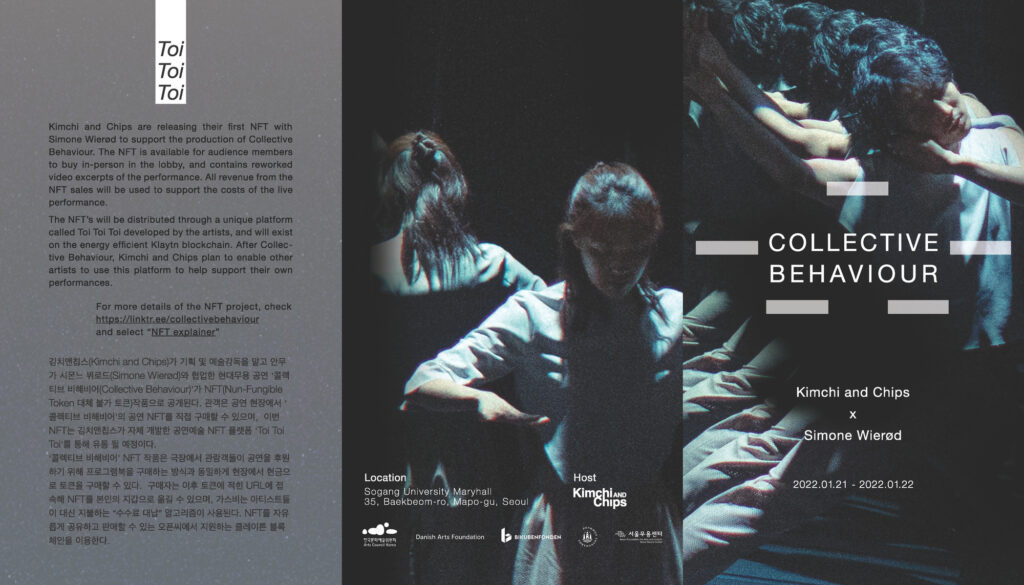

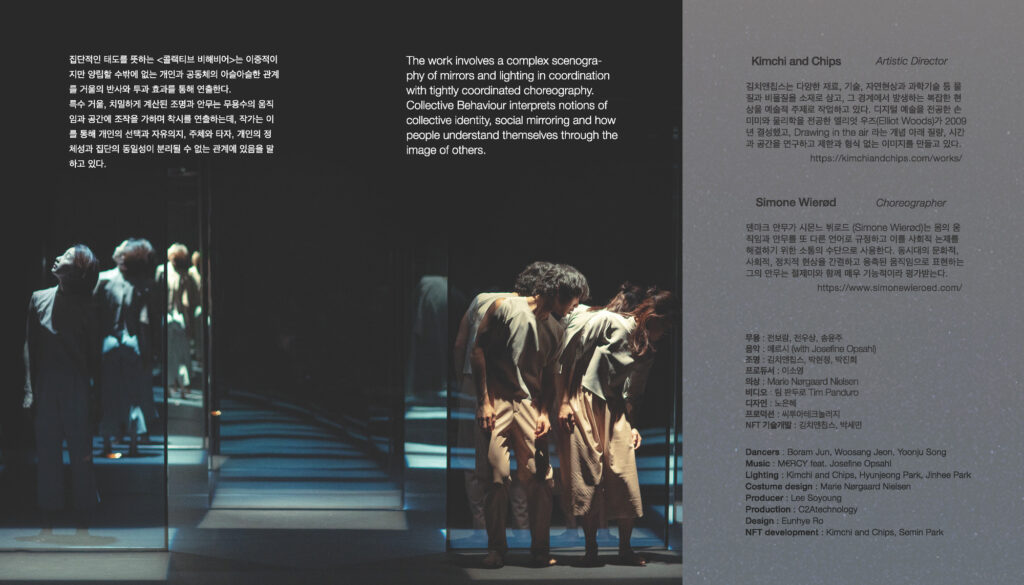

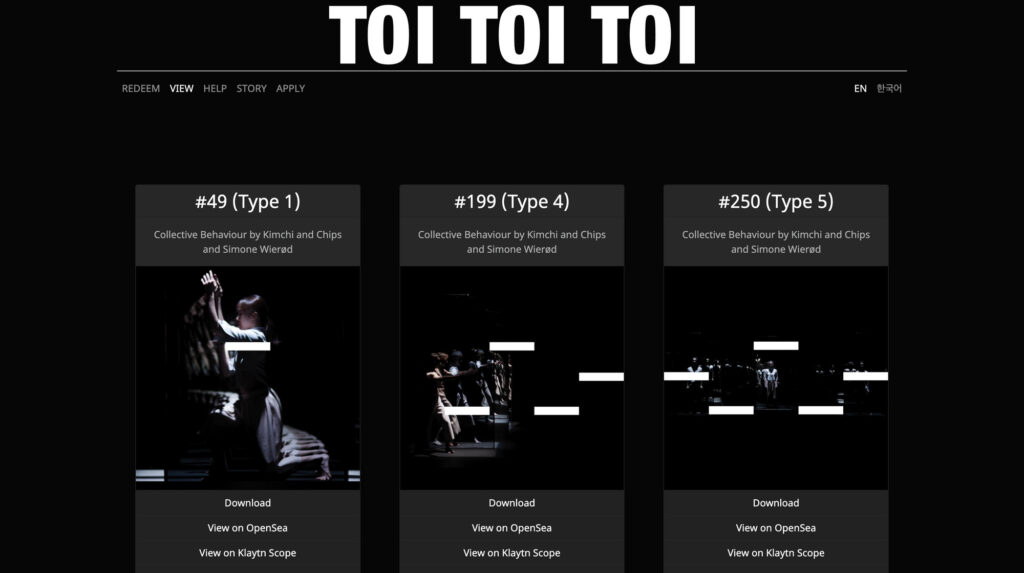

Another great example of the use of NFTs in performing arts is the Collective Behaviour project, a collaboration between Danish dancer and choreographer Simone Wierød and South Korean arts studio Kimchi and Chips. This is an example that I find particularly interesting, as the hybrid business model behind it combines both live and digital activities. In the context of their free physical performances in Seoul, South Korea, in 2022, a collection of five NFTs was launched on the purpose-built Toi Toi Toi NFT marketplace. The collection contained video material of the performance and was available for audiences to buy in person at the venue during and after the performances.

In our recent interview, Simone Wierød recalled that for many audience members, it was their first experience buying NFTs, kind of like a gateway to the NFT market. Kimchi and Chips, who created the NFTs based on the physical performance and also the bespoke NFT marketplace, paid particular attention to designing the customer journey to be as smooth as possible. This meant producing a step-by-step guide on how to buy the NFTs, providing customer support at the venue, and perhaps most importantly, avoiding the bottleneck created by the use of cryptocurrency by enabling audiences to purchase the NFTs with traditional currency. The NFTs were priced at 100,000 South Korean Won, which is equivalent to approx. $78 USD. Over 50 NFTs were sold; not all audience members bought them, but a high percentage did. Some even collected all the five NFTs, because if bought as a bundle, buyers would receive an additional sixth NFT as an extra. All the income from the NFT sales went directly to supporting the live performance.

There were clear benefits offered by the Collective Behaviour NFT project. There was an obvious financial benefit, as the NFT sales partly funded the tour, and a marketing benefit, as the novelty aspect attracted increased interest in the physical performances. The project also contributed to establishing a dialogue with South Korean audiences and creating a digital community around the performance. The possibilities of leveraging this type of committed digital community, who have already invested in your artwork, is something Simone Wierød wishes to explore with future projects.

NFTs have recently made their way also into the circus industry. In the context of the Finnish Lumo Company’s new contemporary circus performance FINELINE, we launched an NFT collection based on the Fineline show. The collection includes short videos and photographs from the performance and is available to buy on OpenSea. The NFT collection is part of Lumo Company’s performance-led research project, funded by Nordic Culture Fund, where we research new digital business models and global digital infrastructures for contemporary performance.

The potential of the NFT market for performing arts practitioners is definitely worth exploring. NFTs may provide a novel avenue for generating revenue, engaging with new audiences, and preserving the industry’s rich history. As the future unfolds, we may see an increasing number of performing arts companies delving into the realm of NFTs, and witness innovative approaches to translating the essence of live performances into captivating digital forms. In the meantime, performing arts practitioners should continue their creative explorations with NFTs and stay attuned to the potential risks and opportunities presented by this new Web3 technology.

To navigate this evolving landscape, technology expertise is definitely needed, which is something performing arts practitioners often lack, and therefore, it’s appropriate to conclude with this great piece of advice provided by Simone Wierød to those performing artists and organisations who wish to enter the NFT market: “You should team up with someone who has the same knowledge of the digital realm, as you have of the physical space.”

All images are courtesy of the artists and the author....

Do you have a story to share? Submit your news story, article or press release.